A Gold IRA is a hybrid type of investment vehicle that combines characteristics of traditional IRAs and stock market-based investment vehicles such as 401Ks, 403Bs, IRAs, etc. Similar to these other types of tax-deferred savings accounts (traditional IRAs, 401Ks), A gold IRA enables its holders to use their money for retirement purposes and also offers them the ability to invest in precious metal investments like gold silver, platinum, and palladium.

Gold investors under this plan can select from many Gold IRA providers and fund managers who offer various kinds of physical holdings of the precious metal, including bullion and ingots.

If you are interested in a company to help guide you, there is an Oxford Gold Group review that you can look more into. Oxford Gold Group is an excellent company in our eyes, but do your research first.

Benefits Of An IRA With Gold Investments

As mentioned, an IRA with gold investments has several unique benefits over IRA accounts. Some of the main benefits include:

1. The option to invest in physical gold

With a gold IRA, investors can choose between holding gold bullion coins in their possession to buying exchange-traded contracts for precious metals such as ounces of gold. This gives the investor greater flexibility in how they would want to allocate their retirement portfolio.

2. No Required Minimum Distribution

One must be 59 years old before taking distributions out of their IRA. Most of us do not have enough time or experience to know what we should do about our retirement portfolio until we reach this age. However, a gold IRA eliminates this problem since you no longer need to take a distribution out of your IRA account before retiring. You continue receiving income from your account whenever you withdraw it.

3. Access To Precious Metals

As opposed to most other investment portfolios, IRA’s allow one to invest in various precious metals, including gold, silver, platinum & palladium. While physical gold usually represents the largest portion of the entire portfolio, it is common to see pension plans holding varying amounts of all four precious metals.

4. Tax Benefits

Although an IRA account does not provide any specific tax advantages over other types of saving accounts, there are certain tax advantages associated with owning gold coins and bullions. While the value of gold is subject to fluctuation depending on the current financial markets, there are periods when the price of gold can significantly increase or decrease. During such times, if an investor sells their bullion holdings, they will incur capital gains taxes on those sales. If instead of selling the bullion, the trader decides to keep their gold and reinvest in newer pieces of gold, then capital losses could offset some or all of the gain resulting from the sale. Since capital losses have lower tax rates, substantial tax savings may be realized from keeping the original investment while acquiring new ones.

5. Low Maintenance And Administration Costs

Another critical advantage of having a gold IRA is that it requires minimal maintenance and administration costs. There are a few simple things that an investor needs to do to avoid incurring unnecessary fees. For example, you need to verify the identity of the person who has control of the account, the custodian’s bank address, and the transaction amount. However, once these checks are done, the process becomes virtually free from additional charges.

6. Inflation Protection

Alongside its great tax benefits and low overhead requirements, another major advantage of possessing a gold IRA is that the asset class remains largely immune to inflationary pressures. Because gold tends not to be influenced by price changes, investors tend to retain their purchasing power when increasing demand caused by inflation increases the supply of gold. Even though gold prices can rise significantly during market downturns, investors remain safe because their underlying gold investments retain their value.

This is one of our favorite reasons to get a gold IRA. And remember there is Oxford Gold Group and tons of other gold IRA companies that you can use to help you.

7. Portability Of Wealth

Another significant advantage of gold IRAs is that, unlike more traditional IRA accounts, these accounts are considered portable. This means they can be moved between employers without affecting the accumulated wealth in the account. This greatly simplifies ensuring your retirement plan contains sufficient money for yourself and your family members.

8. Easy Access To Your Investments

An important advantage of holding gold in an IRA account is its easy access. An individual who holds their gold in paper typically has to pay to send them elsewhere for storage and transportation purposes. On the other hand, since gold is hard to move in large quantities, people would normally opt to store their bullion locally. However, with gold being stored electronically through an international network of buyers and sellers known as the “gold market,” there is no need to worry about physically transporting any of your gold holdings. You log into your Gold IRA broker account and make payments or request withdrawal. The entire process is virtually seamless and painless.

While this information might seem quite overwhelming initially, we hope that it has helped shed light on the many advantages of gold investment. We encourage you to investigate what type of gold IRA is right for your situation before deciding whether it’s worth considering participating in one.

common. These coupons provide users with a discounted cost of a specific product. As the name suggests, they are made and distributed by the manufacturers of the product. The majority of stores will accept these coupons as the discounted cost will be reimbursed by the enterprise that printed the coupons.

common. These coupons provide users with a discounted cost of a specific product. As the name suggests, they are made and distributed by the manufacturers of the product. The majority of stores will accept these coupons as the discounted cost will be reimbursed by the enterprise that printed the coupons. while local newspapers are a good coupon source, they are also directly sent to your mailbox. Additionally, local businesses frequently group together and provide the community with coupon booklets.

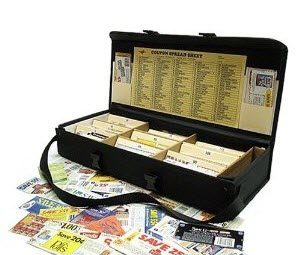

while local newspapers are a good coupon source, they are also directly sent to your mailbox. Additionally, local businesses frequently group together and provide the community with coupon booklets. be slipped into the pages and this makes it easier for shoppers to flip through and take note of what is available when planning to shop. Coupon organizers can also come in the form of small accordion folders in which coupons can be organized by their expiration dates.

be slipped into the pages and this makes it easier for shoppers to flip through and take note of what is available when planning to shop. Coupon organizers can also come in the form of small accordion folders in which coupons can be organized by their expiration dates.